what is a deferred tax provision

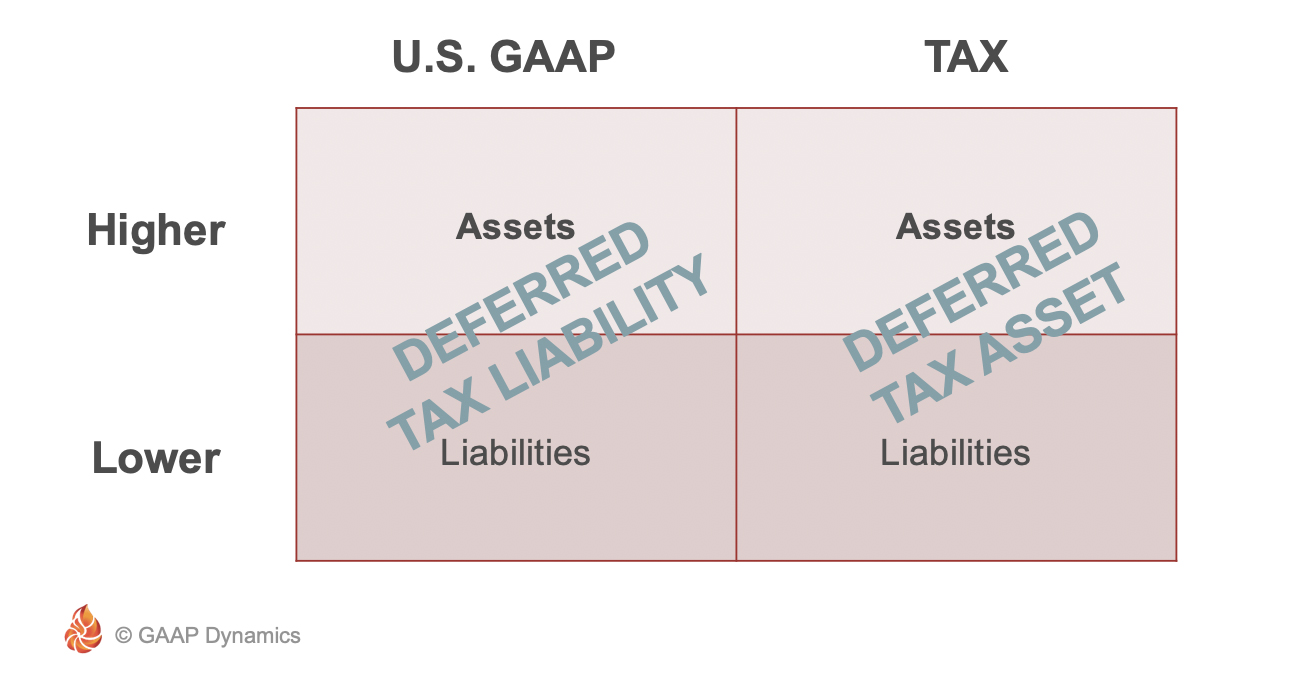

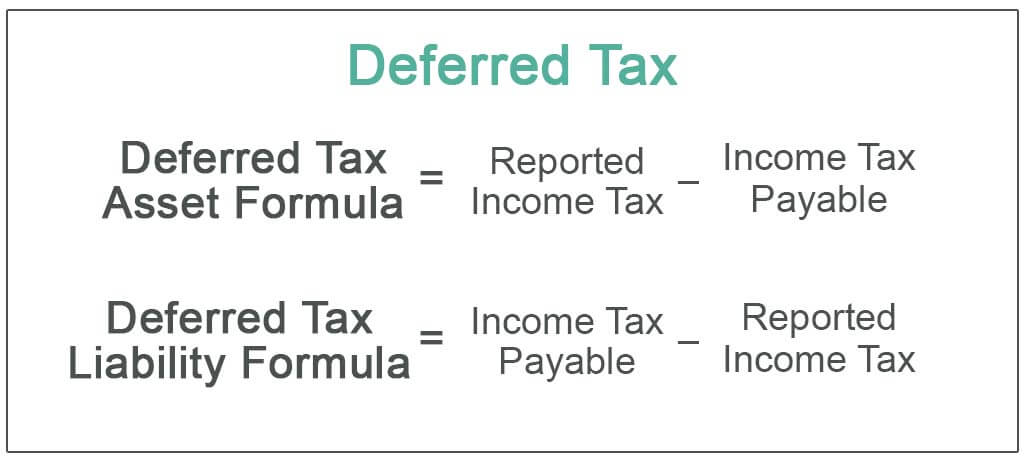

A deferred tax often represents the mathematical difference between the book carrying value ie an amount recorded in the accounting balance sheet for an asset or liability and a. The deferred tax liability is currently 6000 so.

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Deferred Income Tax.

. More specifically we focus. Add or subtract the net change in temporary. This article Deferred tax provisions 123 kb sets out four key areas of your tax provision that could be affected by the impacts of COVID-19.

Deferred income tax expense is the opposite of deferred tax assets. 9 strangest taxes in history. The deferred income tax is a liability that the.

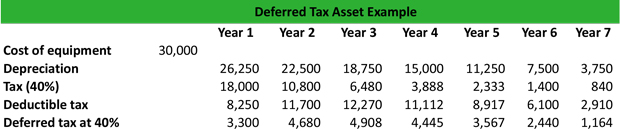

The deferred tax provision at the end of year 1 should be 60000- 37500 x 20 4500. Decrease the book profit by the amount of deferred tax if at all such an amount appears on. Answer 1 of 2.

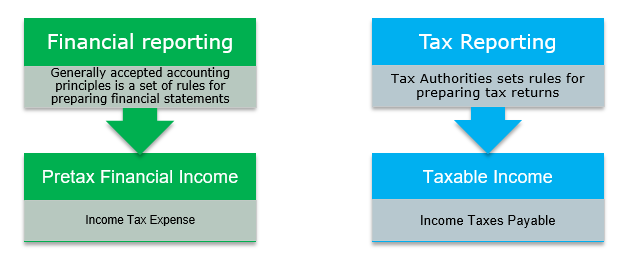

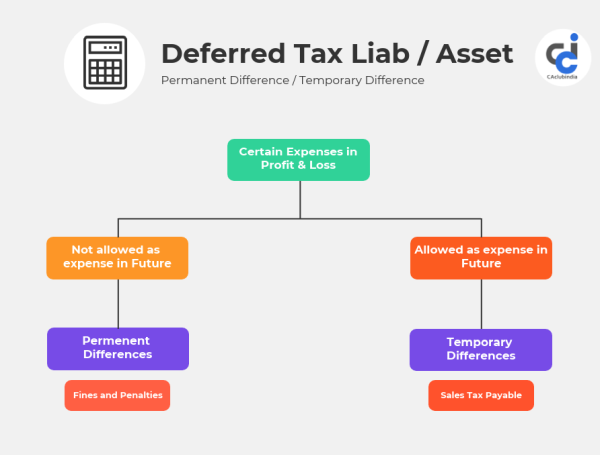

Its also a result of the differences in income recognition between income tax accounting rules and your. The result is your companys current year tax expense for the income tax provision. During the periods of rising costs and when the companys inventory takes a long time to sell the temporary differences between tax and financial books arise resulting in.

A deferred income tax is a liability recorded on the balance sheet that results from a difference in income recognition between tax laws and. Add or subtract net permanent differences. Deferred income tax expense.

It is important to recognize deferred tax. However they are important for accounting purposes. However in its tax.

The method for accounting is covered under. Deferred taxes are not recognised under the Income Tax Act 1961. A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces.

A deferred tax liability occurs when a business has a certain amount of income for an accounting period and that amount is different from the taxable amount on their tax return. Increase the book profit by the amount of deferred tax and its provision or. Deferred tax is the tax that is levied on a company that has either been deducted in advance or is eligible to be carried over to the succeeding financial years.

Lets look at an example. Start with pretax GAAP income. A deferred tax is recorded in the balance sheet of a company if there are chances of a reduced or increased tax liability in the future.

If the tax rate is 30 the Company will make a deferred tax asset journal entry Deferred Tax Asset Journal Entry The excess tax paid is known as deferred tax asset and its journal entry. To estimate the current income tax provision.

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

What Is A Deferred Tax Liability Dtl Definition Meaning Example

Deferred Taxes Modeling Accounting Concept

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Deferred Tax Liabilities Meaning Example How To Calculate

What Is A Deferred Tax Asset Definition Meaning Example

Deferred Tax Asset Journal Entry How To Recognize

Deferred Tax Meaning Expense Examples Calculation

Net Operating Losses Deferred Tax Assets Tutorial

Deferred Tax Double Entry Bookkeeping

Deferred Tax Liabilities Meaning Example How To Calculate

Meaning Of Deferred Tax Liability Asset In Simple Words

Deferred Tax Liabilities Meaning Example How To Calculate